Today’s post covers some quite disparate topics that have no common theme, hence the quote from the Walrus and the Carpenter by Lewis Carol. Is the world we live in Alice’s wonderland? Well yes and no. Where to start? ‘Begin at the beginning, the King said, very gravely, and go on till you come to the end: then stop.

“To talk of many things: Of shoes—and ships—and sealing-wax— Of cabbages—and kings— And why the sea is boiling hot— And whether pigs have wings.”

Supply, demand and demanding:

Why is it so hard to buy in?

We talk to lots of people each and every day and the same comments keep coming up, particularly in the entry level of the real estate market: we’ve put an offer on three places we like and missed out on all of them! Demand is outstripping supply and every week we see this getting worse not better. The fact is that due to a number of factors, WA has a housing shortage. For years we couldn’t build enough to cope with for the reasons you already know: population growth from East Coast migration, shortage of land development, and a materials and skilled workforce shortage.

Throw in Covid shutdowns halting builds and baby boomers doing nationwide hot laps with their caravans and the number of new dwellings just wasn’t enough.

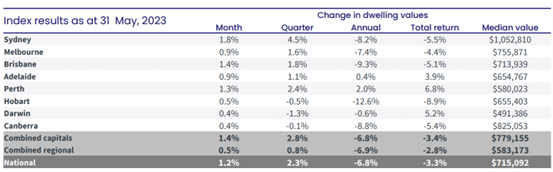

Add to that a shortage of listings and the net result is a 2% growth in property prices and scarcity of available houses not seen in a generation

Index Results as at 31 May 2023 - Source: Corelogic 1st June 2023

Look before you leap, but for how long?

We have dozens of pre-approved clients seemingly frozen in place waiting for something to happen. Rates to go down, house prices to come down, the return of Hey, Hey, it’s Saturday, the list is endless.

Our answer is the same: make an informed decision based on what you know. Not what Wazza said at the pub, not from the echo chamber of social media or muppets on reality tv shows.

Making sound decisions based on reasonable assumptions and hard evidence is the only way forward.

The golden rule: Every deal starts with three things.

- What have you got?

- What can you afford?

- What do you want to do?

My advice – Do your research, create a plan, and stick to it. Any property millionaire will tell you that. And unless Wazza is already a millionaire, smile, nod and keep walking. Talk is cheap and your hands aren’t for sitting on.

Gatecrashers and ring ins, oh, and you nice folks.

It always makes me smile with Sandgroper pride when I meet one of our East Coast cousins moving over. For most of my life WA was regarded as (and we were regularly told) purgatory for anyone from the East and now here they are sitting on our beaches, staring at our sunsets and buying our houses at a rate of knots.

Why? Besides the obvious idyllic beaches and Golden sunsets, property here is cheap. How cheap? Cheap-cheap like a budgie cheap.

I once had a discussion with a Victorian client that was honestly distraught. Her mortgage was coming off the fixed period (they fell into the trap of buying the most expensive house they could afford at record low rates and fixed for 5 years: wise? I think not, but more on this another day).

This family was up for an increase in repayments of $80,000 per year due to the size of her mortgage.

Yes, that’s right, an extra Eighty thousand dollars.

This year. Next year. Every year until retirement. What would you do with $80 Grand of after-tax dollars?

Here comes the new boss, same as the old boss.

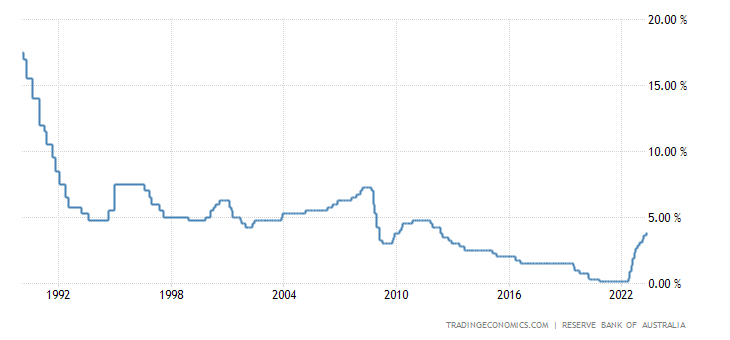

The long-term average rate or slightly higher is where we see the rates are returning to after a long time of extraordinary low rates going back before Covid.

This means the norm of 6-8% bank mortgage rates, the dollar at 55-60c to the USD.

Those of us old enough can remember 18% mortgage rates which were not fun times. People still bought homes, just less celebrious and a bit smaller.

Reserve bank rates from 1990-2023

Going steady and long term relationships.

No this isn’t a chapter from Dolly Magazine’s Dolly doctor page (if you’re under 40 ask your Mum), Westpac has stated in Sarah Sharples’ News.com.au article that the worst of the property nightmare is behind us and stabilization is the new phase..

Ms Sharples quotes Westpac economist Bill Evans house prices are expected to remain flat this year, he believes they could jump higher in 2024.

“Australia’s housing correction is largely over, several factors combining to produce a stabilisation,” Mr Evans and senior economist Matthew Hassan said in a market update.

“Prices now expected to lift 5 per cent in 2024, revised up from 2 per cent.”

Overall, Westpac has predicted house prices will soar by 5 per cent in both Sydney and Melbourne, prices will jump by 6 per cent in Brisbane and rise by 8 per cent in Perth in 2024.

They go on to say that this is largely due to fewer listings, which we can interpret as a no one selling / no one’s losing scenario.

The washup

For every hawkish prediction there is a dovish one and I’m still not convinced these are actually words, but the underlying message I have is that there are no do overs and you only get one chance at life.

You can be scared, or you can do something with it.