Our house, in the middle of our street.

The great housing shortage and why thinking differently will prevent profound sadness.

We are all, to so some extent, creatures of habit. We have absorbed some the lessons and logic of our parents and those around us to form our view of life.

We turn in circles, form Cliques and generally associate with those of the same basic opinion, which is why Christmas lunch at your in-laws can either be great or a fate worse than that of the Turkey on the table.

And so it goes that saving up and buying a house to live in is the low risk, rational accepted norm for us all to aspire to.

It’s comfortable, it’s the best way to financial security, owning your own home is the Australian dream, isn’t it?

The problem with this is “societal norm” is that it creates demand and when the demand exceeds supply, the prices for our sought-after prizes start to get beyond our reach.

Being part of the flock and following the presumed “sensible” thing to do with your money also results in fishing in the same pond as everyone else, and this creates problems.

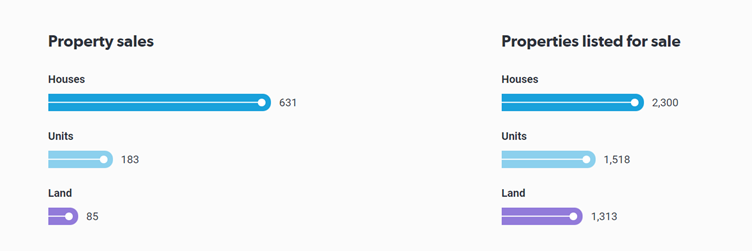

Courtesy of REIWA 10/09/2023

Here in Western Australia, we have a housing shortage. Actually, that’s being generous; what we have is a housing crisis.

We normally have 15-18,000 homes for sale at any one time. Right now, there are a little more than two thousand houses and 1,500 units.

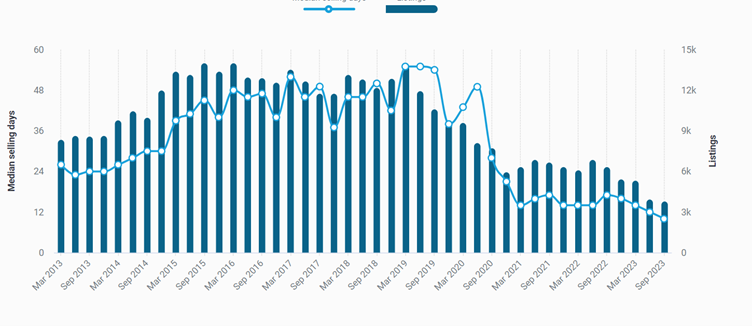

Courtesy of REIWA 10/09/2023

The graph above shows 3,850 properties for sale in September including vacant land, trending downward.

Additionally, news has filtered down that WA’s largest builder is not taking any new contracts for the foreseeable future, and the average build time is about two years, often closer to three.

This week has been a tough one. I’ve had a couple of lovely clients that want to live in a given suburb near their son’s school, have saved a considerable amount of money, only to find that they are well short of borrowing capacity necessary and the prices in their chosen area are still rising.

They were in despair and their dreams, as they knew them, were in ruins.

Their options as they saw them were to keep saving and renting for years, by which time they’d be to old to get a mortgage over a reasonable term, or live miles away in a worn out shoebox mortgaged to the hilt.

There was nothing I could do to get them into the home they wanted, no matter what I tried.

It was at point that rather than give up, I was reminded of what my esteemed mentor once told me: “if you don’t like the hand you have, change it”.

Those of us old enough will know the Joe Jackson song “You can’t get what you want, ‘till you know what you want” (I knew I’d get a classic rock quote in here somewhere…) is true in the market we have today.

Bear with me, it’ll make sense soon: with the market in this state, my advice is to them was to have an honest conversation and determine what is it that you want the most because in this market you can’t have both: to live in that suburb or to create wealth through property investment.

I presented these couples with the basic facts: This is what you have, this is what you can afford, what do you want to do? Buy way out there or try something else.

The something else is to buy a property to while renting in the suburb that you want to be in.

Want to go further? Why not develop the rental property and create wealth to fund them into their chosen location.

In the longer term (2-4 years) they’d have enough to comfortably buy in the suburb of their choice without any issues, even allowing for property price rises.

Yes, there is risk, and it will take time, however in the instance of these two couples, the alternatives were not a reasonable option. By changing the game, they will live in the suburb they want, on their own terms, with much less debt.

Just not right now.

I’ll take that over never any day.

Would you like to discuss how a staged build to rent property development strategy can get you to where you want to go Get in touch with us to discuss your options.