Quarterly Finance Insights by Troy Clayton.

Hands up all of you that are tired of hearing about COVID. Aside from an endless stream of news for the media, the main result of this pandemic seems to be uncertainty.

To banks and lending institutions this is a heartburn inducing scenario where the investments they make today (i.e., whether or not to give you a loan) are based on information that can change in an instant.

Without going into a boring diatribe about lending, the interest rates we pay reflect the risk the bank is prepared to accept, plus their costs and a profit margin in return for giving you their money to buy something, while you take years to pay it back.

While writing this piece I have on my other screen a report from a well know credit reporting agency into the effect of Omicron on Australia’s economy. There are a dazzling array of charts and graphs to display the unemployment rates, underutilisation rates, the inflation rate and a host of other data that means little to you and me.

Except it does affect us in ways we cannot easily see.

This information affects the lenders Credit policy (the rules by which lenders make their decisions on whether you get that loan) and this policy changes often.

In the past three months I have seen a tightening of credit policy and rising interest rates, particularly fixed interest rates and a change in what projects they will invest in which is interesting in itself.

It shows where the banks see interest rates going and their view of risk.

Rates get fixed at about where they see them being at the end of the fixed term (so the bank doesn’t miss out on too much interest) and the trend in projects effects the appetite (for example no lender wants to have all of the 4 on 1 title unit developments in Australia on their books in case that particular market fails).

In the past two to three years, lenders were very eager to secure medium term income security for their balance sheets by offering large discounts on fixed rates. The net result was an influx of customers willing to fix for a period of time and thus ensure the bank had a stable income during the uncertain financial times created by COVID and other world events.

Recently though this approach has seemed to have been reversed with inflation in the US reaching record levels, and in Australia, vaccination levels allowing for greater freedom reinvigorating economies in some states, and shortages of basic goods in Australia having an inflationary affect.

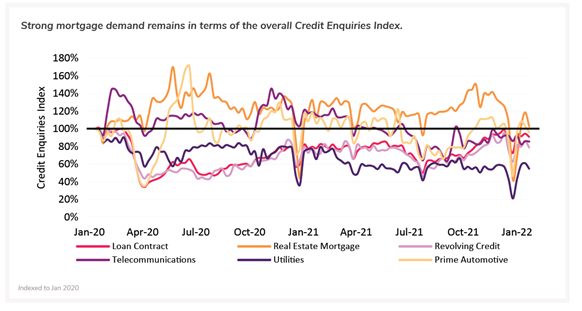

Graph of the Month

Graph of the month is the Credit inquiries index. What does it show? Well, to be honest, that in the last year we are still doing about the same and that’s a good thing. We’re still buying cars, houses, getting phones and utility bills; life goes on.

Graph Credit: Illion Monthly Economic Health Check.

Open boarders closed borders or wherever the wheel of fortune lands next cannot be known to any of us, and the result is uncertainty. And Heartburn.

Fortunately, there is an answer – Solid research and professional advice. Knowing who will lend what, to what extent and that the project assumptions and projections are realistic is the key.

Feel free to get in touch with me to discuss finance for your development aspirations in the development climate.