After what seems to have been a protracted break for everyone in Western Australia over the festive season, we are now all back at the wheel of our business and personal endeavours. A quick survey of the state of affairs brings us to prepare our Perth property market predictions for 2023, based on assessment of facts. The following are my forecasts for the Perth property market into 2023, that will impact how we develop:

- The new West Australian medium density codes will roll out in September of this year, providing new opportunities for diversity in dwelling typology and design outcome pathways, to accommodate a much needed mix in ranges of dwelling types and affordable housing in medium density areas (R30 to R60) of local government around activity centres, arterial roads and train stations. The codes are actually released now under a “deferred gazettal” arrangment and elements of these codes are to be given due regard in certain circumstances (refer DPLH website).

- Energy costs and material costs, working hand in hand, will probably continue to climb into 2023, the major drivers being either ongoing underlying production and then supply shortage (demand outstripping), the energy crisis courtesy of the war in Ukraine (transport and fuelling costs) and China’s ongoing grapple with getting its supply chains and factories open again whilst managing Covid-19 spread in their enormous population.

- I expect interest rates to keep nudging up as long as inflation continues and borrowing/consumer spending is rampant. You’d be surprised to know that people are still spreading, & borrowing, aggressively. Until we return to cruising speed, I expect more rate hikes, however the rate of increase will slow.

- New dwelling approvals (issued build permits) are now at their lowest point in about 4 years. In feb/march 2021, it was almost 2600/month. November last year saw this number down in the 800’s. Whilst I don’t see material cost going backwards in a hurry, pressure eon labour, and labour rates, will ease. I already have civil and demolition contractors coming at me with no work, and the bricklaying rate is fast falling away from the $3/brick we were paying even 6 months ago.

- Population growth, and thus demand for housing, is still growing. And I don’t see it going backwards. One of my agents had 70 people for a rental home open last Saturday. Values, and rent yields, will continue to grow, in WA and the Perth metro region. This is spurred by new interstate and overseas migration, which is starting to gain steam, for work and affordable lifestyle reasons (we have a median house price approx 50% of Sydney or Melbourne). I expect Perth to continue a growth trajectory for another 3-5 years at least, and am comfortable the market could go 3-5% a year in that timeframe.

- We see the entry of “economic refugees” to our state market. The overwhelming majority of my enquiries so far this year online (as at feb 6th 2023) have been from eastern states investors who have sold up or are selling up properties form their portfolio that are beginning to slide, and using the money (after 10-15 of solid uplift) to purchase or develop investment properties over here. They are optimistic, they are many, they are excited about WA’s affordability and good rental yield, and they are coming. This will add further immediate pressure to housing stock and competition for sites, and drive up values here.

At some point in the next 6-12 months, as labour costs at east start to stabilise, we will see the lines of value uplift and cost stability/decline intersect where it starts to make sense to develop again. The key is acquiring property and getting your planning approvals in place now (6-12 month process), so you are ready to pull the trigger on a build ahead of the pack, at the right time, and get your product to market first once things stack up again.

Are there property development projects stacking on paper now? There sure are, but we are engineering them heavily and being very creative. Vanilla, run of the mill developments arent working. we have to push planning regulations and build technology hard.

In case you missed the snapshot at the end of last year, here is stuff we worked on last year (2 out of ground one in working drawings now) that work on paper, and will look even better once values move up and costs stabilise over the next 12 months. Here they are again below.

CASE STUDY 1 – GROSS PROJECT VALUE $500,000 TO $1,000,000

Project: 3 lot Retain and subdivide with construction of 2×1 small dwellings

Land Size: approx 750m2, zoned R30

Location: Southern suburbs metro council

Project Details

A staged Property development sourced through an acquisition specialist. Peak equity input (not all in one hit) was approx. 500k. this was a 3 lot subdivision with a renovation, and then construction of two 2×1 small dwellings. Due to rising market and growing rental demand this will be held to rent for the time being. This Project will give an equity uplift of approx. 35% for 18 months and there is a net rental yield nearing 6%, which is pretty tidy.

| Total Cash Outlay (note- in stages) | $333,798 |

| Total Debt Funding | $671,000 |

| Profit before income tax | $130,108 |

| Indicative ROI (if sold on completion) | 34% |

| Nett Rental Return P/A (Interest only) | $21,505 |

| Nett Rental Yield P/A | 5.7% |

CASE STUDY 2 – GROSS PROJECT VALUE $1,000,000 TO $2,000,000

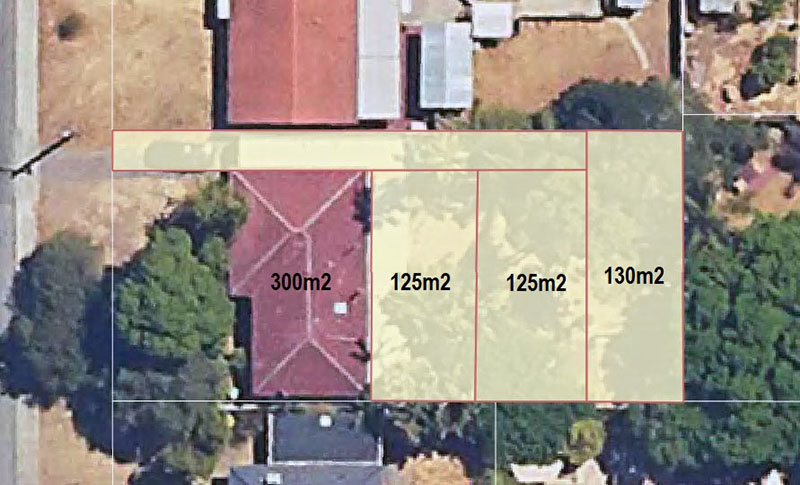

Project: 4 lot Retain and subdivide with construction of 2×1 small dwellings on the rear.

Land Size: approx 750m2 zoned R60

Location: Southern suburbs metro council

Project Details

A Buyers agent helped secure this pre-market site. The property development was done in stages, meaning peak cash outlay was under $600,000. Subdivision into 4 lots was done first, with a retained dwelling renovated on the front. Then, three 2×1 small dwelling lots were developed. This was stage two, the delivery of three double storey small dwellings using a lightweight framing process to get construction to under 12 months this project achieves a rental yield of near 5.5% nett, and a leveraged value uplift (if sold on completion) of around 35%. Not bad for a small suburban backyard.

| Total Cash Outlay (note- in stages) | $440,315 |

| Total Debt Funding | $1,072,250 |

| Profit before income tax | $147,588 |

| Indicative ROI (if sold on completion) | 34% |

| Nett Rental Return (P/A) | $23,738 |

| Nett Rental Yield P/A (on interest only) | 5.5% |

CASE STUDY 3 – GROSS PROJECT VALUE OVER $2,000,000

Project: Multi dwelling project consisting of seven two storey small dwelling typologies between 90 and 140m2 GFA each

Land Size: approx 900m2 zoned R40

Location: Inner eastern suburbs metro council

Project Details

This design outcome was achieved my rounds of design review and negotiation with council and DRP consultation. Site yield was optimised through a design principle assessment approach, where trade offs were made to get this project over the line in planning. There is a mixture of 2×2 and 3×2 dwellings with varying access options to accommodate a diversity of occupant types. Front and center stage was also energy efficiency, increased landscaping and water sensitive urban design principle incorporation. A framed and infill panel construction methodology will be used to get build delivery to under 12 months in a pilot project delivery approach. This is a build to rent project, delivering a rent yield scenario of approx 7.5% P/A nett. A value uplift if sold on completion of approx. 50% will be possible on based on current valuation.

| Total Cash Outlay (note- in stages) | $889,019 |

| Total Debt Funding | $1,893,765 |

| Profit before income tax | $415,777 |

| Indicative ROI (if sold on completion) | 47% |

| Nett Rental Return (P/A) | $65,330 |

| Nett Rental Yield P/A (on interest only) | 7.3% |

Make 2023 your year to get a good project on the go.

Whether your budget is well under or well over a million dollars, let us help you strategize, source and succeed in the medium density infill development space in 2023. This is where the wins will be had in the coming years, and good medium density outcomes is a space we have now become experts at finding, planning and delivering. The trick is to get moving now, ahead of the pack. Get in touch today to get a seat at the table and have an initial interview with us about working together.