Quarterly Finance Insights by Troy Clayton

Fortune favours the brave when gloom is the new black.

In my previous quarterly articles I warned of rising interest rates and tightening credit policies: this is now old news with any number of experts decrying a fall in house prices across the nation.

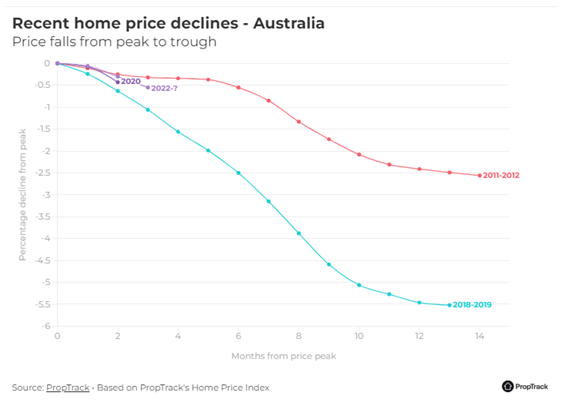

Indeed, in a recent very well researched article by Eleanor Creagh, senior economist for Real Estate.com.au, Eleanor covers the full history of property values over the last 32 years, showing that while negative equity events happened only 5 times, current estimates of property values falling anywhere between 15-30%.

Given this and the increasingly negative sentiment surrounding the property market, you would be forgiven for retreating at full speed to stuff you cash under the mattress at home and you would not be alone.

Misery loves company and the media and the device you’re probably reading this article on, are surrounding and bombarding the you and everyone else with bad news creating a whirlpool of negative opinion.

The optimist in me sees another path, one that is not well travelled, nor without its own risks.

Those without the constitution for risk need not apply.

Investing in a declining market has risk, rising interest rates will eat into profit margins, and tightening credit policies will exclude some investors, of this we cannot argue, however how many people buy bitcoin when the market is stratospherically high? When the frenzied media attention is focused on celebrities making inordinate amount if money only to find they go in just as the easy cash train drew to a stop.

The same goes for the stock market. When the news is great, the media are all over the story and everyone sighs and thinks, why didn’t we buy in back then.

I would like to make the argument that now, or any time before we see a significant rise in the real estate market is “back then”. And yes, that is the definition of an existential dilemma.

You will have to negotiate tighter credit policies and account for higher interest rates, however timelines for a typical development are about two years, coincidentally the same as the troughs in the above graphs. What better time to get started?

By starting now, and doing your homework, there is a case to say that when (and the graphs show us there is always a when) the markets return to positive territory, you will be on the right side on the ledger.

Investing by definition, is putting your money into something for a return in the future, and when and how much to invest is decide by what is right for you and this is the million-dollar question.

Get in touch with Troy and the Subdivision Experts Team today to discuss working with us to position yourself for future success in the property development space.