Development Site Finder Metrics – The Rule of Three

What are the best suburbs to develop and subdivide in?

Want to become an expert development site finder? Well, becoming an expert development site finder requires skill and expertise. This article will explain the metrics you should be assessing when considering which suburb or area to be developing in at any given time. These metrics are important for you to understand and be able to assess. The status quo of what to develop and where to develop is changing constantly, so you need to be on the ball to ensure you are offering the right to product to the right market, in area that is worth developing in because there is demand for your product type. If you dont understand these metrics you may end up developing in a suburb where you will struggle to sell or even lease your product, and may even have to sella at a discount, resulting in lower profits or even a loss.

There are different schools of thought and strategies to pursue when it comes to researching and choosing the right property development site. In my experience, which and what metrics you choose to consider when selecting a property to purchase for development will ultimately come down to personal circumstances (primarily funding capacity), your assessment of which buyer profiles in the market are currently active, and your appetite for risk.

I have consistently pursued a strategy based around a lower appetite for risk and the need to mitigate around the volatile (boom and bust) cycle of the Perth property market. Owing to wild fluctuations in immigration and capital expenditure from business and government in the state; many suburbs which seem like lucrative prospects can be in the doldrums only a year later. Some suburbs in the last bust lost as much as 20% in value in an 18-month period. Other suburbs saw consistent growth year on year despite a declining economy and poor housing demand across the state. Why?

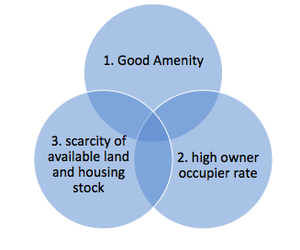

Here are three key property development site finder metrics I have developed which I believe are formula for success. Each of those suburbs that has outperformed the state average consistently appear with each of these three characteristics. In fact, they almost always appear together, and if a suburb has two, the third will appear soon. Herein lies the greatest opportunity for capital growth to appear simultaneously with a development that sells quickly – a perfect partnership.

The three metrics for choosing a property development site I use are below which will be discussed in more detail in this article:

figure 1: Three key development site finder metrics.

Metric 1: Good Amenity

Good amenity can be perceived in simple language with the phrase ‘why would I live here?’. It is arguably the most important of the metrics for you to become proficient at researching in order to become a good property development site finder.

There are many reasons people move to a suburb or ultimately choose to start looking in an area. Price is a determinant, but not the only one. Owner-occupier end buyers are ultimately buying on emotion. This is where the magic happens for a developer running a real estate business. If you pay attention to wants and needs of the buyer that are not just price centric, you can command a price which will be above the market average. This is called capital growth, and in real terms for the developer it also means a quick turnaround period for the project driven by sales with high price stability.

Focusing only on the price metric is ultimately self-defeating. The only customers you will attract with this strategy will be fickle, prone to haggle and unlikely to have strong financial credentials meaning settlements will always be protracted and tenuous.

Alternative wants and needs warrant more consideration. These include broader social reasons people will pay anything to be in that location (amenity) :

- Closeness to work and employment

- Closeness to their family

- The beach and sporting facilities (a major consideration in WA)

- Education (some ethnic groups place a high value on education and being in the catchment for performing or prestigious schools will be a high priority)

- Cafes, restaurants and bars

- Health facilities (over 55’s)

- Crime rates

Already you will notice a causal relationship between our golden three; there is always more demand in areas that have amenity and prices are higher because of competition. As we progress you will see that any areas you can think of that have one or more of these reasons mentioned above are already difficult to find stock in and have a high owner occupier rate.

Metric 2: Find a Development Site in an Area With a High Owner-Occupier Rate

This is an important metric. There are two reasons for this; and they tie into the relationship between our rule of three and a macro consideration of risk mitigation.

Follow the tribe

Humans are group animals. They stay together. Biology and research support this. In fact, social psychology tells us that 80% of people move back to within 10KM of where they grew up or where their family was later in life. These are your second home buyers. Their careers are stable, they have good lending capacity and they are cashed up. They generally come in pairs, with dual incomes or a sizeable asset base already either through inheritance, divorce, career, savings and equity from their first home. They will pay what it takes to get their ‘forever house’ because that is what they want. This is not up for negotiation.

By the time these buyers start looking for their new place, they are already 90% committed to the idea and the sale follow through rate is astonishingly high; so long as they think your development fits their wants with regards to the reasons discussed in the amenity section above. Affordability is not the main consideration; this is an emotional purchase and if they pay a bit too much the general attitude remains ‘who cares, we have 30 years to pay it off’. These are the perfect customer.

What is important to note is that you are more likely to find these customers in areas where there is a high owner occupier rate. This is because the buyers own families and friends (their ‘tribe’) are more likely to live in areas with a high owner occupier rate. Their friends and perhaps their own parents still live there. They are coming back home and are wiling to pay for the privilege.

It’s all we’ve got

All suburbs have profiles and cycles. This is largely determined by the type of people that live there.

In a suburb with a low owner occupier rate, it means that housed that are not owner occupied are either vacant or tenanted. There are a few problems with this:

- There is generally less care for property amongst renters – the streetscape deteriorates and the overall appearance of the neighbourhood declines

- Renters may not stay for long. There is less connection between neighbours; street awareness is non-existent, and crime is more likely to go undetected and as a result; rise

- Vacant houses contribute to the ‘ghost town’ feel

- Renters are more likely to have less disposable income meaning that local shops and businesses are unlikely to thrive and provide attractive amenity for potential newcomers.

It can generally be inferred that the above reasons are negative aspects of a rental suburb and contribute to a downward spiral if they are not countered with economic growth in an economy and increased home ownership in the area.

The greatest risk to developers in low owner occupier suburbs is when an economy experiences a shock (like a mining downturn). Capital flow through the economy slows down and financial stress is experienced by those who are over exposed. This is the Achilles tendon of suburbs with low owner occupier rates (which for our purposes here I will denote ‘investment suburbs’). An investment suburb looks like an attractive place to buy when the economic times are good. Purchases are often by higher middle-income families. Often these buyers know little about property investment. It just seems like a good idea at the time because they have excess cash, the economy is booming, and they are confident. Someone at the pub says you should get an investment property; their friends have all bought a rental house in the same suburb and the real estate agent say that getting a tenant is easy. What could go wrong!!??

What goes wrong is that their purchase is based purely on their emotional confidence. The sale of the investment property (of theirs and their friends) will follow the same reasoning pattern. Once the economy contracts and they are not confident, their income decreases, the investment property is the first thing to go on the market for disposal. Their property, and many others who bought similarly, will go on the market at the same time. The outcome of this is that many investment suburbs experience high, and often rapid, peaks and troughs, in their price lifecycle as the market is flooded with product. When times are good everyone want to buy in them and when times are bad everyone sells in them. The effect on the median house price in these suburbs is self-explanatory.

Conversely, suburbs with a higher owner occupier rate will generally not experience such high peaks and troughs in their pricing. They may even experience growth in times of economic contraction (albeit small) because these suburbs’ demand is being driven by different factors – timeless ones as discussed above. If a high volume of housing in an owner-occupier suburb start going on the market it can be inferred that people are selling because they have no other option (this excludes normal sales patterns resultant of deaths or downsizing). Sudden, high sales volumes in owner-occupier suburbs are not the norm and are generally only a phenomenon in times of great economic depression (like those pre and post world wars). Returning to the key benefit of our argument for high owner occupier suburbs – they are more likely to perform over time and less likely to experience sharp contractions in asset price relative to an ‘investment suburb’.

Metric 3: Scarcity of Available Land and Housing Stock

To become a good development site finder, you also need to consider stock scarcity. The business of property development operates on the same basic principle of supply and demand of any economic activity. Where there is low demand and oversupply, real estate pricing contracts. Conversely, where there is high demand and low availability of product, real estate prices increase.

Returning to our rule of three, we see now the symbiosis between the three metrics. In a suburb with good amenity there is naturally going to be high demand. A high owner occupier rate also contributes to demand because of social factors discussed above.

Both good amenity and high owner occupier rate mean that less housing stock in that area is likely to be on the market. Owner occupiers are entrenched and unlikely to move. This produces a bottleneck on supply. When supply is constricted, and demand is high; we see price growth in a suburb. Any stock that does come onto the market will attract a premium price and will sell quickly. The benefits of this to property developers are obvious.

Summary of Development Site Finder Metrics

As stated, there are different strategies to pursue in property development. These are all predetermined by personal objectives and appetite for risk. Some developers actively pursue developments targeting first homeowners and renters. For the reasons outlined in this ‘rule of three’ article I trust it makes sense to the reader as it does to me that developments are better pursued in areas that meet the rule. Chiefly, I believe this de-risk the project and ensures projects are pursued in areas with near term prospects for economic growth. These opinions are my own and have been developed through my own experience.

The obvious relationship between the three metrics means that they will oftentimes be found together. As I alluded to at the start, if you can find a suburb with two metrics, say a high owner occupier rate and a scarcity of stock, the third (being good amenity in this case) is never far away. These are potential growth suburbs which may not yet attract the premium for entry level investors; but which, in my opinion, still represent better prospects than a purchase in an ‘investment suburb’.

For those with the appetite and capacity, I would strongly encourage pursuing a property development in a suburb that meets all three criteria. This comes with a cautionary note that in all developments the profit is made in the purchase and not the sale, a principle discussed elsewhere and in other articles we have published. It is practical to remember that when applying the rule of three you will be competing for development sites with owner occupier buyers who will be prepared to pay more for the land than a shrewd developer would – so just bear that in mind.

If you are uncomfortable researching and finding development sites yourself, FLYNN are experts athelping you with finding development sites and researching them with feasiblity studies.