A Big Farewell to 2022: A Western Australian Property Developers Year in Review

How we have saved the bottom line with Medium Density Developments in the post Covid frenzy.

It is no secret that its currently an incredibly tough time to develop property out there. There has never been higher demand for housing stock, but it’s also never been a riskier time to engage in project delivery. There are the cost blowouts from runaway price inflation. Unquantifiable lead times. Materials shortages, no tradespeople. Aggressive but necessary monthly rate rises from banks. Overpriced development sites everywhere.

Have you been busily trying to stack up sites over the last 12-18 months, and can’t make it work? You aren’t alone. The old suburban battle axe? Doesn’t make a dime. Get a nice corner site and build three townhouses? Lucky to get 10% on paper for a 3-year turnaround.

Not a lot is working, and here is a few major reasons why:

- Cost to build has gone up 30-50% in this time period, but end values haven’t followed suit.

- High demand for labour and materials off the back of global economic stimulus measures, means not only have rates and prices gone up, but supply shortages have also been exacerbated. Things are sold out everywhere, and some trades have 6 month lead times just to get to site.

- The rising cost of borrowing (monthly RBA increases to tackle inflation) is only compounding in your spreadsheets as project timeframes for conventional build methodologies double or triple.

- In the infill space, you are competing with emotionally charge owner occupiers for development sites. These punters are buying in desperation just because they need somewhere to live, right now. We are short some 25-30,000 supply units of housing (at current population levels). For many desperate families, renovating or making do in an old pushover is more attractive than the nightmare of building a new home.

- A burgeoning, archaic and bureaucratic planning framework that is not adapting fast enough to rapid new dwelling commencement and diversity requirements.

If you tie all this together, we have a scenario where its hard to get labour, everything is costing far more than it should, conventional build time frames are out the window, and the market values of finished products don’t make it worth taking development risk. It’s a tricky spot. So what do you do? Wait for the labour and materials market to settle, and values to catch up?

Hell no, what a waste of time. You’ll just be sitting back getting ready to compete with every other tom, dick and harry in a few years’ time, when the problem might have (not guaranteed) sorted itself out and people realise stuff “stacks up” again.

What you need to do is accept the reality of how the economic climate is now, and that we don’t know when it will change. Your job is to find a way to make things work in this environment. This means looking at innovative alternatives to address every shortage or problem there is, including aspects of;

- dwelling diversity and product mix,

- design outcome pathway,

- build methodologies and technology,

- labour and material sourcing,

- funding

To succeed, you need to take personal responsibility for finding different ways of adding value to your projects throughout the property development process, using creative ideas and approaches. Front and centre is considering how to deliver more easily constructible product types to the market, and also delivering product types that have appeal to a larger section of prospective buyers in a rapidly deteriorating affordability market.

As much as money is dearer to borrow for the developer, so too it is for the homeowner. To boot, the cost of money and the family home is just one consideration. The consumer is now paying upwards of $2.20 for a litre of diesel and 30-50% more on a range of other living expenses, from flights, to groceries, utilities and insurance. Even my Adobe subscription went up by 36% this year; the dinosaur bones used to power the internet have never been dearer.

As long as CPI rates continue to outstrip wage growth at the alarming rate it is, consumers will become very mindful of the largest expense they have, their mortgage. The answer therefore lies in smaller dwellings, not bigger ones. This means Medium Density development, with more diverse ranges of smaller housing options in established areas that are closer to amenities, facilities and public transport.

In pursuit of this new flavour, we have been busy investigating and executing these sorts of projects for the last year to meet the growing demand for new dwellings, with product that is summed up as affordable Medium Density infill. And that means nice, contemporary and energy efficient dwelling choices in better areas that people can service with their proportionate income means, not cheap kremlin style apartments.

Leaning away from conventional vanilla developments that use the old build technologies we know and love, we have been able to secure and make sites stack up, even whilst paying market rates for land, construction and lending. This is a direct consequence of simply by being innovative with product mix, design and delivery methodology.

Lets take a look at some examples of what we have been up to.

CASE STUDY 1 – GROSS PROJECT VALUE $500,000 TO $1,000,000

Project: Retain and subdivide with construction of two single bed dwelling lots (SBD’s).

Land Size: 771m2 zoned R30

Location: Southern suburbs metro council

Project Details

Property sourced and purchased with Buyers agent assistance and expertise. Development done in stages, keeping capital outlay at any one time well under $500,000. A three lot subdivision was undertaken with a retained dwelling which was efficiently renovated to bring it up to the local sale standard. The plan had been to sell the existing house prior to building two 2×1 homes, one street front and the other on a rear block to decrease exposure prior to outlaying build funds. Due to rising market and strong rental demand the decision has been to made to hold the existing tenanted property until after the builds are completed (estimated early 2023). The builds are energy efficient small dwelling typologies, single storey 2×1. Project delivers promising equity uplift near 35% for 18 months and a net rental yield above 5%.

| Total Cash Outlay (note- in stages) | $333,798 |

| Total Debt Funding | $671,000 |

| Profit before income tax | $130,108 |

| Indicative ROI (if sold on completion) | 34% |

| Nett Rental Return P/A (Interest only) | $21,505 |

| Nett Rental Yield P/A | 5.7% |

CASE STUDY 2 – GROSS PROJECT VALUE $1,000,000 TO $2,000,000

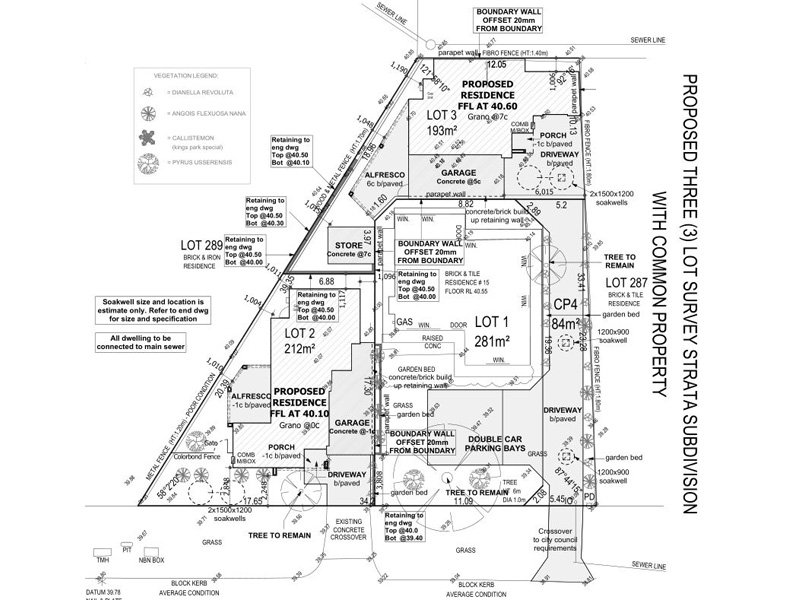

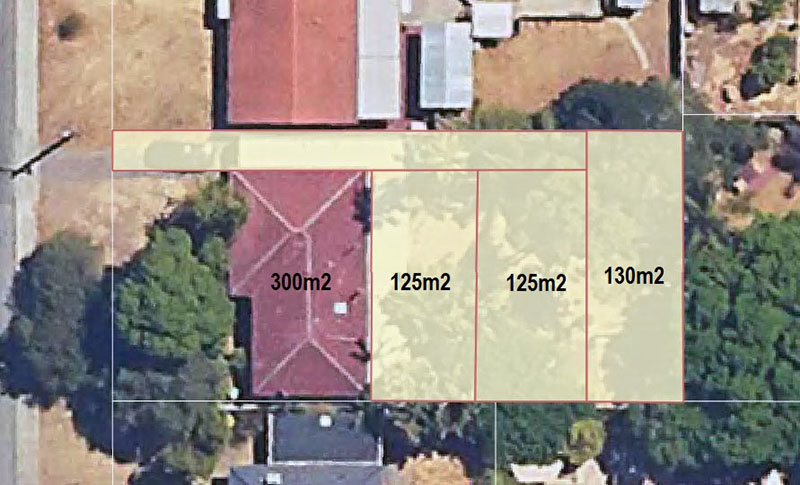

Project: Retain and subdivide with construction of three single bed dwelling lots (SBD’s).

Land Size: 764m2 zoned R60

Location: Southern suburbs metro council

Project Details

Property sourced and purchased with Buyers agent assistance and expertise. Development done in stages, keeping cash outlay at any one time under $600,000. The first stage was subdivision into 4 lots with a retained dwelling (3 small dwelling or SBD lots) concurrently with a cosmetic renovation of the retained house for immediate lease. Stage two was delivery of three double storey small dwellings using a lightweight framed energy efficient build methodology to get construction to under 10 months. The innovative building methodology used on this project have facilitated a reduced initial outlay on development site works and overall build spend. A nett rent yield of near 5.5 % has been achieved (after interest costs) with a leveraged value uplift (if sold) of around 35%.

| Total Cash Outlay (note- in stages) | $440,315 |

| Total Debt Funding | $1,072,250 |

| Profit before income tax | $147,588 |

| Indicative ROI (if sold on completion) | 34% |

| Nett Rental Return (P/A) | $23,738 |

| Nett Rental Yield P/A (on interest only) | 5.5% |

CASE STUDY 3 – GROSS PROJECT VALUE OVER $2,000,000

Project: Demolish and build a mixture of seven two storey small dwelling typologies between 90 and 140m2 GFA each.

Land Size: 920m2 zoned R20/40

Location: Inner eastern suburbs metro council

Project Details

An exceptional design outcome was prepared and negotiated through several rounds of council and DRP consultation to increase site yield based upon a design principle assessment approach. There is a mixture of 2×2 and 3×2 product typologies with varying universal access standard compliance. Energy efficiency, exceptional landscaping and water sensitive urban design elements were captured in the brief and has assisted in the delivery of a lengthy but exceptionally satisfactory outcome for the client and consultant team. A lightweight framed energy efficient construction methodology will be used to get build delivery to under 12 months. This is an intentional build to rent project, delivering a net rent yield scenario of just under 7.5% P/A after all holding and interest costs. A leveraged value uplift (if sold) of approx. 50% will be possible on current appraisals.

| Total Cash Outlay (note- in stages) | $889,019 |

| Total Debt Funding | $1,893,765 |

| Profit before income tax | $415,777 |

| Indicative ROI (if sold on completion) | 47% |

| Nett Rental Return (P/A) | $65,330 |

| Nett Rental Yield P/A (on interest only) | 7.3% |

Get Involved. What are you waiting for?

The majority of builders and developers in Perth have been busy anxiously spinning their wheels, lamenting over the difficulties of trying to make conventional development approaches work and stack up, largely thanks to the things we have already discussed. These are meteoric rises in material and labour costs, chronic shortages of supply of both (with no end in sight for the medium term), increasing interest rates and tighter credit policies at banks, and fierce competition from owner occupiers who are over bidding on development sites just because they need somewhere to live.

As the old saying goes, you can’t push a square peg through a round hole. It’s time to accept that what worked a few years ago is now well and truly broken, and probably is for good. It’s time to move onto doing things in a way that works for the end buyers, the developers bottom line, the current supply market (of everything, from money, to timber, to skilled labour) and with the types of sites available.

With a select team of consultants, financiers, and builders, we have busy testing and succeeding with alternative design and delivery strategies in the Medium Density development space. There is a missing middle for infill development of products between apartments and townhouses, which we have now become proficient at finding, planning and delivering.

Whether your budget is well under a million, north of two or anything in between, we can strategize, source and deliver the right medium density project for you. The trick is to get moving on this before the new Medium Density Codes are out next year and everyone is trying to get a piece of the action.