This article has been carefully put together to provide Perth property market predictions for 2022. It has been a wild and abnormal year in the real estate and the development space in Western Australia since Covid-19 started. A lot of organic and artificial factors have impacted real estate demand in this time. A look at the data to hypothesise what has happened and where we might be headed will be key to not just getting a foot in the door, but a foot ahead, in a very hot and competitive property market.

The low down on property market predictions

Property market predictions for Perth are anything but easy. This is true of any market. The economist Bernard Shaw is attributed with the statement ‘if you laid all the economists in the world end to end, they would not reach a conclusion’. Still, we try.

I am no economist, but as an avid property developer and keen market spectator, I do my research into any market I participate in and make the effort to use what I know about the current trends to predict possible outcomes. This shapes not only my own strategies and acquisitions, but those of our client portfolio. I am pleased to say that we have had a good run to date.

2021 was a continuation of the wild ride that a COVID government stimulus package market shocked us with. Supply chain shortages and delays, pinches on labour, closed borders, aggressive government stimulus, and a bullish speculative investor sentiment on the safety of housing stock saw national housing prices boom. Cheap credit and FOMO (fear of missing out) continued to fuel what government building grants started in late 2020. National average growth was tipped to hit more than 20 percent. No capital city, and indeed some regional ones, were immune. And that is just the average meaning that many suburbs across Australia recorded quarterly growth in excess of five percent – simply unheard of to date.

Western Australia has been no stranger to the party – our average growth has been 18.1 percent in the last year, with regional areas outstripping their CBD cousins – showing an average 19.9% increase in dwelling values (CoreLogic).

The lift in equity and disposable income has fuelled a bonanza in consumer spending. What economists call the wealth effect (where your house suddenly becomes worth more and you feel safer and richer) is likely to produce a bumper Christmas for retailers. Shops, bars, and clubs are also reaping the rewards, especially in WA where lockdowns have been at an almost nil effect. The amount of household wealth income going to savings (near 25% during peak COVID lockdown) has been unleashed as disposable income. Savings have now dwindled to less than 6% in most income brackets. Party is in full swing, and there doesn’t seem to be an end in sight in the land of milk and honey. Or is there?

I’m going to review a few scenarios and cross reference that with a smattering of analysis and season with a little bit of common sense to serve up a property predictions 2022 Christmas turkey I hope the reader finds edible.

The Oven

The property oven is currently blistering. Home prices in Australia have risen more than twenty percent in the last year in what has been the biggest housing boom since 1989. We really cooked the goose last time this happened – but more on that later.

The traditional method used by the government and the RBA (whether they would admit it or not) has been to promote the wealth of Australia based on our property values. Today this sits at a whopping 9 trillion dollars (CoreLogic); almost 30 percent higher than the estimated value of Australian Super (one of the largest pools of money in the world). This puts Australia at the top of the list for wealth per capita – we eclipsed Switzerland some years back.

So why aren’t we all driving Lamborghinis? The problem with this statistic is that, foolishly perhaps, it does not consider the net wealth by accounting for the debt. We are essentially ‘borrowing our way into wealth’ (if that makes sense!). Although a ludicrous notion, what has made this sustainable is a combination of low unemployment, generous lending conditions and, until recently, sustained demand on housing thanks to migration.

The reality today, as presented by the ABC in the documentary Going, Going, Gone (available on iView) is that housing ownership in under 30’s is at its lowest level since post world war two. We are no longer operating in a marker where first homeowners are the key driver. In fact, a growing portion activity is driven by second and third home buyers, investors, and speculators both directly and indirectly. What I mean by indirectly is that many young entrants rely on mum and dad to go guarantor on their loan. This means that in real terms, they cannot actually afford to enter the market. The octogenarians, the baby boomers, are pumping up their own market. It seems almost inconceivable that a property purchased in the 70’s for fifty thousand dollars could sell 40 years later for over 3MIL, but that is what has happened thanks to sustained, and perhaps unrealistic purchases.

The question becomes, is this sustainable and are there grounds for optimism in the near term (2022)?

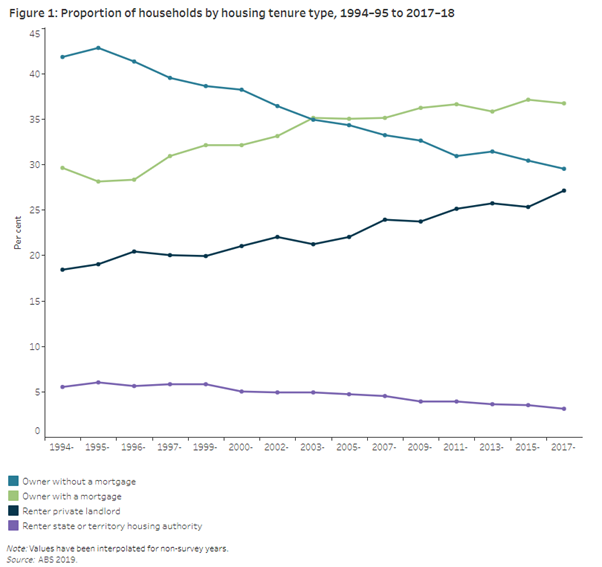

The Turkey

Every good Christmas lunch demands a Turkey, a large one preferable. The Western Australian Turkey is about 2.667 million (Sep 2020) people big with about 1.1 million dwellings (from id community). Of these, 64% of households were purchasing or fully owned their home, 22.4% were renting privately, and 3.8% were in social housing in 2016 (from previous census). The following graph is national and shows a proportion of houses by tenure since 1994 -2018. Unfortunately, we do not have data from the covid period yet. However, the trend is obvious we can see clearly here that overall Australia has seen a decline in owners without a mortgage, and sustained growth in debt accumulation since the last crash. As a nation, we are proud assumers of monetary debt both at a government and household level, where debt continues to grow. Percentage of renters has also increased.

The Stuffing

Sustaining supply and demand curve that continues to promote house price growth for over twenty years in no mean feat. A multitude of factors have contributed (not limited to):

- Strong immigration (demand)

- Limited supply (building times, supply of housing – especially pre and during COVID)

- Affordable lending

These three of these factors, apart from the first, have been strong drivers in WA in the last two years.

Migration is set to rise when the border opens. Home affairs is touting that it can stuff another 160,000 people into the country by the end of 2022. The question verily arises, where will they live??

Rental vacancy rates across the country are at historic lows. Build times, historic highs. Price escalations – pandemic. In Western Australia alone, it conservatively costs 20-30% more to build a home than it did this time a year ago. Base line materials, labour, rent, and transport are going up, substantially. It is hard not to call this inflation, although that is what the reserve bank is shying away from.

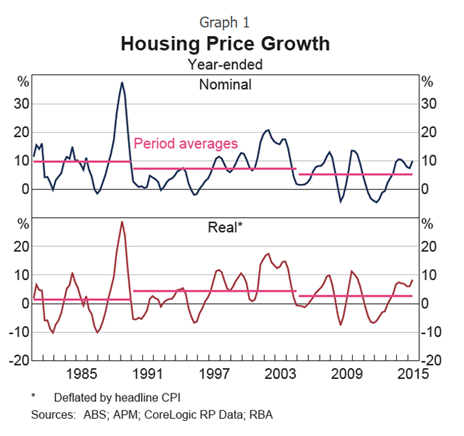

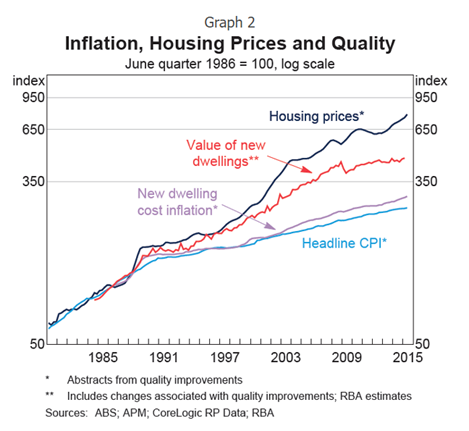

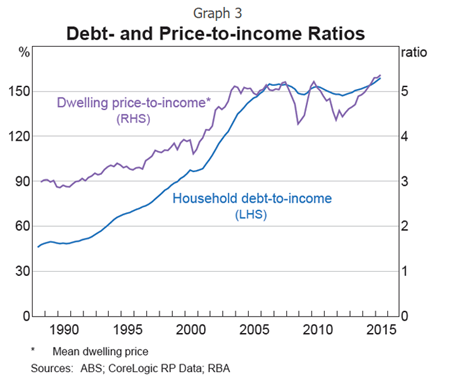

We mentioned previously that we have experienced the strongest growth in housing since 1989. That was just before the last crash Australia had – Paul Keating’s ‘recession we had to have’. It is interesting to consider the following graphs from that period:

What we see in graph one is year ended house price growth, looking at period encapsulating the 1989 boom (which on scale only, is comparable). What is relevant to note here is the ‘amazing growth’ followed by the equally ‘spectacular fall’. Tables Two and Three shed some insight into the situation.

Graph two shows the beginning of inflation – where the disparity between the value and cost of a dwelling started to deviate or be outgrown by the actual price of the house. We can see that today; we are far outstripping the trend. In fact, the gap has ballooned – the difference between the house price and the value being what I call ‘hot air’.

Graph Three shows in real terms the more concerning trend (decades long) towards debt outstripping household income and dwelling prices. We are already seeing the effect of this in declining participation of new entrants to the market and pre covid debt stress- the decline in the participation by first home buyers in the market particularly is rapidly deteriorating. And the temporary reprieve gifted by historically low interest rates (now on the move) is just that, temporary.

Salt and Pepper

It would be fair say that housing has become less affordable in Australia, and a fair property market prediction to say that it will become increasingly so. There is no foreseeable change or answers to the supply and demand status quo medium term. Those with housing stock, especially in excess, will reap the benefit of ever escalating house prices and as I predict, exorbitant rent on the back of an inability of migrants and low-income earners to acquire stock or a loan with which to buy it. Western Australia’s one saving grace for hopeful homebuyers is it is coming off the back of a 9-year decline, so rates very well on the national affordability index. A median house price of around 550k is far mor affordable than the million dollar plus median price markets of Melbourne or Sydney.

Landlords will be the big winners this time around in WA. Rental values increased 16.4% across Perth in 2021 and I predict this trend will continue upwards for years to come. This has been determined by undersupply in the market which will become worse before it gets better. Western Australian rental availability is still running well below the 15-year supply average. Further supply pressure seems imminent when the borders open.

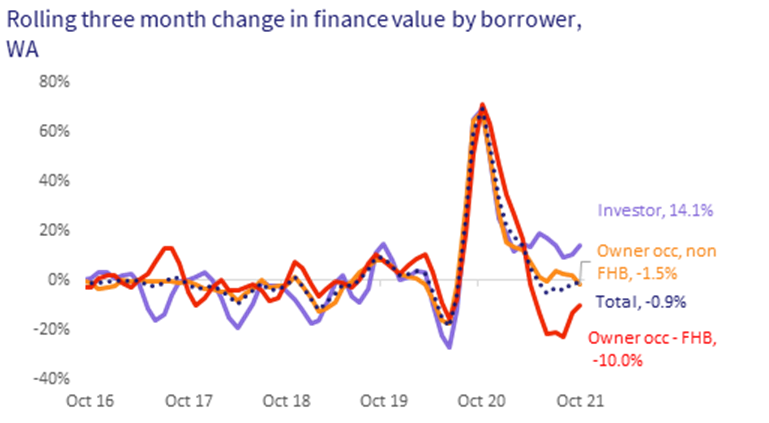

Borrowing from investors seeking to take advantage of the rental uplift has been reflected in the latest loan data from the RBA:

Investor loans in WA are the single biggest movers in the credit market, with first home buyer and second home buyer lending in decline for the last half of 2021. The expectation is for an increase in activity in all segments once the border to Western Australia opens in February of 2022.

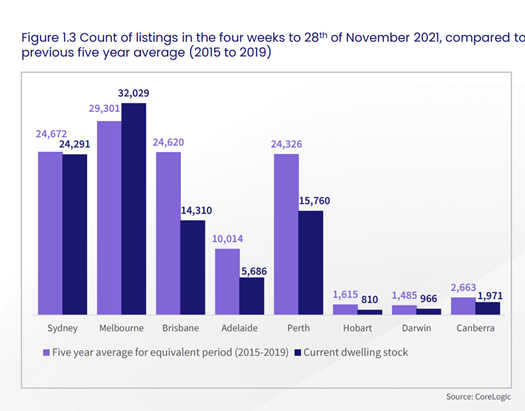

Supply shortage of land is a concern – a predicted average of seventeen to twenty thousand dwelling constructions per annum (ABS) in the state for the next three years will add to housing stock. However this is less than the twenty-three thousand units of land supply added this year and is still below required supply output given the likely migration intake we will receive. Infill targets are still lagging. The current rate of supply output (land and house units) is running a deficit of five to six thousand supply units a year on forecast requirement. Some experts say this means demand will outstrip land supply in the next three years. The combined listings on the WA real estate market (all stock types) in the 30 days to November 2021 are shown below. In short, we are still well under the five-year average of dwelling stock required. Just 10% of the federal government’s migrant intake would soak up current supply.

There is simply insufficient current housing or future land supply (greenfield or infill) in the pipeline to keep up with anticipated demand. It may be fair to say then, that there will never be a better time to have a vacant block ready to sell than late 2022 to early 2023. To hit the sweet spot, your development activity should focus on desirable areas. Targeting non first home buyers or investor type will be lucrative as new investors and upsizers enter the market with gusto. Demand for first home buyer supply is still a few years off recovery, and one suspects affordability will continue to deteriorate over the next few years (cost to build and lending climate). This market segment is precarious at best.

On a more sobering level, I predict that our household debt will continue to grow. Many will be forced to borrow to compensate for their lack of spending power owing to inflated prices of goods. The difference between what we earn, borrow and the real value of our assets will be a giddy headache for many households when interest rates return to a historical average of 4%. Remember, if history is correct (and there is no reason to doubt it), what goes up, must come down. How far down, and when, is the question.

Overwhelmingly, an astute investor can still make a lot of money out of the current climate with the right timing and above all, location, in the next few years. Many areas of Western Australia are still severely undervalued when compared to similar locations and product quality in Queensland, Victoria, and NSW, which are anything but affordable. When we open the border, I fully expect a stampede, driven by both immigration and interstate investment. I still see a strong year ahead for the Western Australian property market, which I think has only just been put in the oven.

The Carve Up

So, what’s going to happen?

Well, to some extent, Christmas lunch is always predictable:

It’s hot, It’s always hot. The air-conditioning has broken and the 24hr electrician – RBA electrics – haven’t been able to fix it. For some reason every button they press makes the place hotter. Dads old mate Mr Morrison tells them to just leave it alone.

Good old Mum is slaving in the kitchen while Uncle Neil, who owns an HMO business and is good friends with the neighbour (the Hon Mr Hawke), is lecturing mum on how we can put a lot more stuffing into the turkey.

Aunty Anne is showering the kids with presents and sugar (which we all know she put on the family credit card we all pay for -she’s been broke for years).

The glazing on the ham catches fire in the oven, Auntie Sue and May are both blaming the Chinese honey, not like they used to get in the good old days they say. And the price of a ham! – you have to give and arm and a leg just for a small one. It’s a shame the family sold the pig farm for a song in the 80’s.

Dads shouting at the Neighbours, he won’t let them in because they’re not double vaccinated. It’s a pity really, their deserts were always the best and we could do with some new company. Plus, Kamal is an electrician and can probably fix the AC.

My business partner and I draw at both ends of a cracker. Out falls a joke – Just one more vax! – why are the jokes always so lame.

I sit there and wonder why each year always seems to repeat itself. Then I reach for the wine. The wine at least is always reliable. I pour an excessively large glass. Maybe next year I’ll get a better cracker.

Property Prediction Summary for Perth Developers in 2022

Perth will likely be the safest city to profit from development of land in Australia for the next few years, for key underlying reasons:

- It is the most affordable capital in Australia at just under 550k median price (attractive to broad range of local, investor and migrant buyer base)

- Supply is well outstripped by demand (undersupply in land. Housing and units) reflected in an 18% increase in price over 2020- 2021 and 16% increase in rent.

- We are well behind our infill and dwelling commencement targets, lagging 10-20% behind required commencement rate at current migration levels

- 160 000 migrants in federal government intake for 2022, just 10% of those would consume all the supply in the WA market, meaning continued upwards pressure on house prices

- Surge in land and housing demand forecast by experts off the back of interstate and overseas migration when the WA state border opens in the February of 2022

- We have a strong local economy and thousands of job opportunities, serious undersupply of houses for sale or rent, and forecast of 8-10% growth in 2022.

We have a low base price (good affordability), latent undersupply (10 years of poor dwelling commencements and land releases) and demand that is about to explode- there are more than 160 000 overseas migrants coming to Australia in 2022, and WA has only 15000 listings on the market as at November this year. Now is a good time to get into the market and capitalise on a migration surge before WA opens its borders.

Want to learn more about setting yourself up for success in 2022? We invite you to get our expert knowledge and set some goals at the 2 day Deal Assembly Property developers Seminar !