Learn how to do a professional feasibility study.

Remove the uncertainty – Make the right choice.

There are lots of choices out there regarding where to develop, what to develop and how to develop property. Once you start looking at sites and try to consider all the options, it can get a little overwhelming. So how do you make the right choice?

The answer is with feasibility studies. Feasibility studies facilitate informed decision making, which is far better than guessing, hoping or praying for a good outcome. The better the feasibility study, the more likely you are to remove uncertainty and make wise investment decisions. Property development is a serious business and whilst it’s a potential stepping stone to financial freedom, it also has potential to be financially ruinous if you are not careful and diligent.

This article explains how we filter through all the options in a staged, methodical approach to finding the best site and the best options for that site.

This is important – The biggest risk of investing in a loss making project lies at the front end, by not getting the feasibility study right (or not doing one at all). If you want to only do profitable projects, feasibility studies are essential. In fact, they are probably the most important part of the whole property development process, and occur before you have even started the project.

Becoming proficient at feasibility studies takes a considerable personal investment of time and money to up-skill. The alternative is to engage experts like us for professional assistance. Either way the deliverables are the same and just as important. You (or us) need to collate as accurate a data set as possible for a site. It needs to identify the risks, revenue and costs associated with delivering the most profitable design solution for that site, in a short amount of time.

Most importantly though, the study is used to identify the most profitable design solution (if there even is one) before you commit to buying or starting the project.

We have a tried and tested, methodical approach to Site Procurement and Investigation (feasibility studies) we do with all of our clients. The two activities occur in tandem, so its important to explain how they work together. Everything happens in a distinct, three part process.

Step 1 : Procurement preparation

The ultimate goal of performing feasibility studies on development sites is to actually proceed with an offer and acquire one of them. So if you do a feasibility study and like the site, it makes sense to be prepared to close on the deal fast. Otherwise you may be doing delusional window shopping (unable to finance), or making an offer under the wrong investment vehicle for lending or tax purposes. This can be stressful, a waste of time, or both. Before you go project shopping, you need to prepare.

- Budget – Determine your equity position, that of your investment partners (if syndicating or JV) and your overall borrowing capacity (pre-approval discussions with a broker).

- Tax Structure – For tax purposes you want to determine (with a tax advisors assistance) which kind of entity is suitable for your project type, given the activity type and the personal circumstances of all participants. This is important – it can affect lending recourse, your ability to utilise the margin scheme for GST, Capital gains tax offsets and your personal tax liabilities overall. You want the right structure set up form the onset. Note: you can fix this by transferring the site to the correct eternity later, but this will cost you refinance fees and stamp duty all over again, and delay the project.

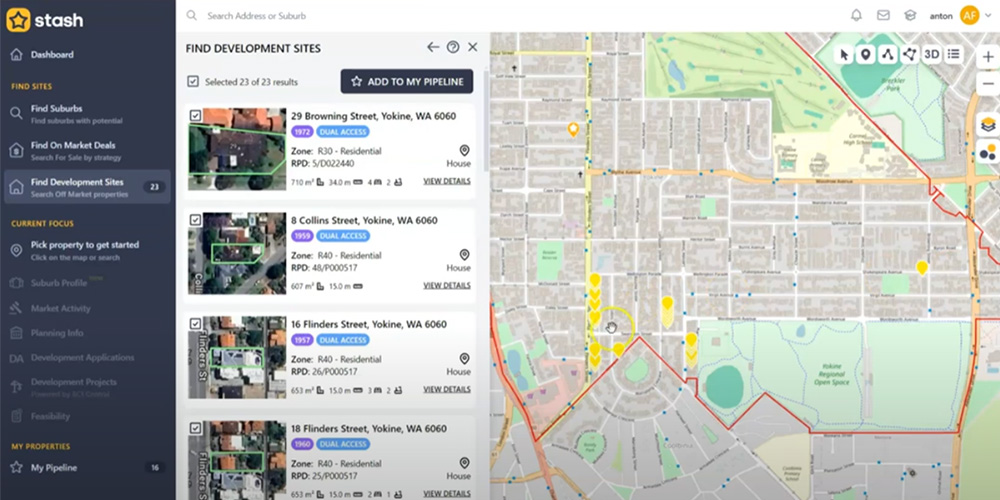

- Strategy – Once you have a put together a tax structure and a budget, you assemble a better idea of what size and type of project you can afford to do. This is when we put together a strategy brief for target sites and the type of development you are going to do (e.g. 2, 3, 4 or more lots, suburb, lot size). Depending on how you choose to source sites – on and/or off market (we prefer to look off market) you can go “project shopping” and start shortlisting sites.

Step 2 : Preliminary due diligence

As you find sites, its important to quickly determine if they have profitable development potential with minimal investigation cost and effort. Particularly if you find a few sites, you want to whittle down the choices early. To this end, you need to do preliminary due diligence for each site you find and determine if there is one, multiple or no feasible design solutions for the site. This is done until you find a site you want to move on and investigate further. This preliminary due diligence involves desktop research and analysis to identify development potential and site constraints (risk items) that will constrain design and affect costs. Spend no more than a few hours on this activity. It involves:

- Prelim town planning investigation (risks and design constraints)

- Online mapping for site constraints (access, servicing, slope, easements etc.)

- Cost estimates (lump sum figures, database subdivision costs, square meter rate buildups for single storey, two storey or other options)

- Comparative market analysis an valuation opinions (RP data, local agents etc.)

- Summary of indicative ROI for all options (land only, single storey, two storey etc.)

When the exercise is complete, you should see where the ROI lands for each option. At the end of this, it should be clearer which (if any) options for the site are viable to pursue further. The numbers here should be good enough to effect a clear decision that making an offer on the site is a good idea, or that you should move onto the next site.

For small two lot developments, anything from 10-15% ROI is realistic and acceptable. Developments of 3 or more lots, 15-20% or more ROI should be a target. Stand alone subdivisions (no building) up to five lots will rarely return more than about 12-15%. Less is not uncommon.

Step 3 : Detailed due diligence

Once you have a site option you want to pursue, we move to the detailed due diligence phase. At this point, you must make an offer on the site “subject to due diligence“, giving you the option to withdraw the offer if your detailed due diligence findings make the deal unattractive. An important note – Do not proceed with an offer if you cannot negotiate a due diligence period with the seller.

The deal should already look good on its own legs from the findings of the preliminary due diligence. The objective at this stage is simply to investigate and cost (in more detail) the major risk items identified at the last stage, and refine the costings and valuations of the design solution chosen with some concept design work. This stage will take more time (negotiate 2-4 weeks in the purchase contract) and will cost money. Any number of the following activities are typically undertaken, depending on the development strategy and site particulars (not all will be applicable to every site):

- Written town planning advice

- Site survey and draft overlay/s

- Concept dwelling sketches

- Builders const estimates of dwelling sketches

- Local agent and/or valuers opinions of revenue based on concept dwelling sketches

- Prelim engineering (geotech/retaining/site-works BOQ and estimates)

- BAL reports or other site investigations as required

- Tax and finance advice based on refined costings

- Revised feasibility spreadsheet and forecast

At the end of detailed due diligence, there should be more certainty that major risk items in design have been captured and costed, and there is a better opinion of revenue. Once you have a revised spreadsheet, it’s a simple exercise of deciding whether to proceed or withdraw the offer based on the improved data you have collated.

Feasibility studies are not a crystal ball, but the data assembled is pivotal in effecting an educated ‘go’ or ‘no go’ decision. Remember, it is entirely possible that the answer based on the data, is to withdraw the offer. Even though you may have spent some money and time up to this point, it’s better to have arrived at the informed decision that proceeding is a bad idea, rather than realising this halfway through the project once its too late.

This is the process of effective, proper due diligence.

If you are serious about profiting from development, this is a non-negotiable and essential step of the property development process. You either have to learn to do it yourself, or if you are unsure, hire someone to help you.

We can help you either way.

Procuring sites and doing effective feasibility investigation is the most important skill-set you can obtain as a developer. You may go through the motions several times over before you find the right site, but it’s much better to do this and arrive at the right choice, than lose money.

There are 3 detailed chapters on; site acquisition, feasibility studies & feasibility considerations in our eBook & Course. Plus, there’s 2 feasibility spreadsheet templates and a tutorial of how to use them. If you want professional assistance with the three steps above, we can do this with you. Learn more about our feasibility investigation services below: