How to become a real estate developer who makes money

Want to learn how to become a real estate developer? What you really want to do is become a successful one, and that requires a skillset and understanding of key principles, that are explored in this article. This article will provide comment and look at how to become a successful real estate developer in the current property climate in Western Australia. It is no secret that the property market in Perth has been very flat for the last few years. Learning to think like a developer and applying profitable principles through clever strategies to your property development will be critical to your success. Remember, property development is running a business, not just buying property as an investment to set and forget.

From the early 2000’s , many people got into developing property and subdividing land in Perth. Most never actually learnt how to become a real estate developer- they paid too much for their land, constructed dwellings that were poor design solutions for the site in question, overspent on the build and took far too long to complete the process. The reality is that over the 12-18 month project period all of their mistakes were covered by exponential growth in the property market, growth fuelled by a seemingly endless mining boom and housing shortage from an exploding population. These “developers” made money from a supply and demand shortage, in a market where desperate owner-occupiers would snap up anything the market offered, not by value adding to the land as a developer does.

Market forces have changed. Many have not made money in the last few years because they failed to learn how to become a real estate developer. They kept doing what they have always done and were surprised when their developments failed. Although we are showing all the signs of the next period of growth in Western Australia, it is important to understand the principles of finding, designing and executing the right development to ensure good returns in the next upswing.

Here are some key principles that will help you learn how to become a real estate developer and succeed:

1. KNOW WHERE TO BUY

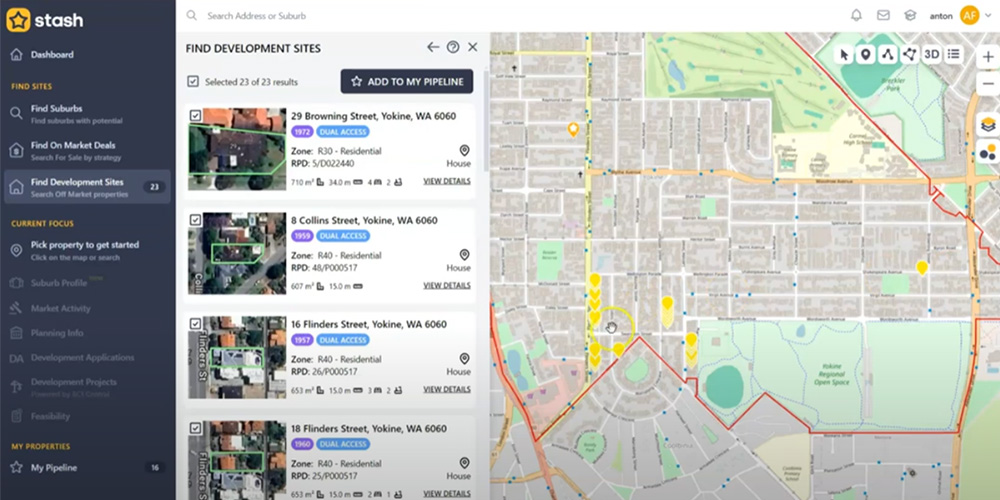

A successful real estate developer considers a number of factors when looking for the next development site. A real estate developer knows there is no such thing as good suburb or a bad suburb – there are good deals everywhere. It’s all about doing your own research, not listening to agent’s spiel and neighbourhood here-say. A smart developer always considers the following when looking at a potential site in a particular suburb:

- Is this a desirable place to live? Look for a high owner-occupier rate. Look for the availability of good amenities and facilities, such as train stations, schools and shopping precincts nearby (planned or existing). Keep the end goal in mind. Generally speaking, as a realestate developer, owner occupiers are your target market, not renters. You want suburbs where people want to buy homes to live in.

- Look at supply and demand in the area. Whether you are looking at building houses, apartments or just selling land, look at the scarcity of stock currently on the market in the area, and also what has sold lately. What did it sell for, how long was it on the market? This will shape your decision on the type of product (land size or dwelling type) you are looking to offer to the market. Look out for saturation of stock that is moving slowly- do not produce more of this and join the queue of desperate sellers!

2. WHAT IS YOUR DEVELOPMENT STRATEGY?

When discussing development strategy, we are talking about how you are going to develop the site in question. You will need to consider the resources you need to deliver the project. A successful real estate developer always considers two things:

- Plan for success. This means spending some time before you begin determining what your budget is as well as when and how it will need to be spent. Work out if you land development alone will give a sufficient return, or if building needs to be considered. Look at the costs in both scenarios. Work out what you can afford to spend on the whole development. What you will spend will be the sum of costs arising from the land development component, the dwelling construction, and a contingency. You may find to actualise every dollar of return out of the development you have to be more inventive with borrowing; find a JV partner, or stage your development into manageable chunks. Doing this may enable you to run a lower debt model with less holding costs. Although the project may take longer to complete, you may find your cash flow more manageable. Failing to plan is planning to fail.

- Tax is real. You also need to consider tax. If you make money from the sale of property you will pay tax on the capital gains. It is important to set up a tax structure for the investment machine before you purchase a site and start a development, not at the end. This will help you plan and possibly mitigate tax expenditure. Your trading structure may also effect your borrowing capacity.

3. ADOPTING PROFITABLE DESIGN PRINCIPLES

This process is called performing a project feasibility study.

Good developments start with good design. You need to do some preliminary design work and costing’s early in the process, ideally before you purchase the site. If you are concerned about loosing the site, it is always possible to make an offer subject to due diligence. Placing an option over the potential acquisition is also a possibility. In the interim, preliminary design work will help you develop the right product for the market, give you an indication the sale price of the end product, and importantly give you a good idea of what the project may cost to execute. If there is a healthy difference between the forecast project cost and revenue (with some room for error) the project is worth pursuing. If there is not, you will either have to revisit the design, not purchase the site or shelve the project. To learn more about feasibility studies we can provide, enquire about these.

It is vital to do this early on- even the most preliminary of investigations may show us that there are 2,3,4 or more development options for a a site. It is important to do some design and cost modelling on all of these options to determine which (if any) option delivers the highest yield for your investment.

Important design principles to remember:

- Your end market is an owner-occupier. Remember that you are ultimately producing an end product for an owner-occupier. Owner-occupiers purchase based on emotion. Bearing this in mind produce something unique, functional and that looks great. This is particularly important in a market saturated with stock- design something that will stand out from the rest. There are innovative and cost effective ways to do this.

- Utilise your site coverage. If you are allowed 55% site coverage, use 55% site coverage. On small blocks under 350m2, every square centi-meter of functional dwelling space is valuable and it’s a waste to throw it away with poor dwelling designs.

- Provide the right product for the market. When doing your market research, focus your product supply to stock that has the highest demand and best likely return. You may find there are lots of 350m2 blocks on the market in the suburb, or an oversupply of 3×2’s that have all been on the market for half a year. If family 4×2’s or blocks over 450m2 are being snapped up in a few weeks then that this a better indicator of scarcity and the right product to supply to the market. Less is sometimes more.

- Maximising returns does not mean building cheap. Produce the right quality specification for the suburb in question to meet market expectations. Simply put, if high quality finish houses in an area are the norm, cheap houses will not sell. Spending an extra 30k per house to ensure a fast sale at a premium price is what is required if the market expects it.

- Research Local planning requirements. Different local governments have different requirements for policy considerations such as dwelling types, energy efficiency, parking and appearance. These requirements can save you money if concessions are provided, but can also cost a great deal more. These requirements will impact design and your feasibility spreadsheets. It is vitally important to understand and apply the Planning Policy and Scheme text provisions of the local government in which your development is geographically located.

To learn how to be a real estate developer who makes money from property developments and subdivisions takes practice and time. You will get better at it as you develop processes to scrutinise property opportunities and decide for yourself if they are actually “good deals”. That means knowledge of design principles, developing strategy, the market and how to perform feasibility studies.

Would you like to learn more about how to become a Real Estate Developer?

We teach aspiring developers the process of how to do subdivision and property development successfully. Our education, information and advice services include subdivision & property development training courses, books, and articles.

Would you like to learn more about how to become a Real Estate Developer?

To become a successful real estate developer like our clients are, you need to begin with educating yourself. You need the property developer mindset: a mindset where you understand both the technical and strategic elements of real estate development. Our clients have alls tarted their property development journeys with educating themselves. Detailed, comprehensive education on strategy, where to buy, what to buy and target markets is contained in our 225 page Infill Property Developer Guide-book and correlating Online Course, along with coverage other important topics like costs, processes and feasibility. Your education is essential to your success- get started today!