What are the secrets to making money in property development?

How do property developers make money in Western Australia?

If you are getting started in property development, you might be wondering how property developers make money? This article looks at three main factors that are paramount to how property developers to make money in the infill development space.

These three factors are Timing, Leverage, and Strategy. Using the right strategies in coordination with timing and leverage will allow you make the most money out of your property development endeavours.

Understanding the different ways you can add value and how to combine them is therefore an important part of your property development education. If you get a good grasp on how and when to employ strategies in the right combination, you’ll be able to maximise your returns and very importantly, have the expertise to see and tackle opportunities that other people have missed or passed over.

Timing makes money.

Firstly, when you buy a site to develop can be critical to your end returns. “Timing, timing, timing” is far more important than “location, location, location”.

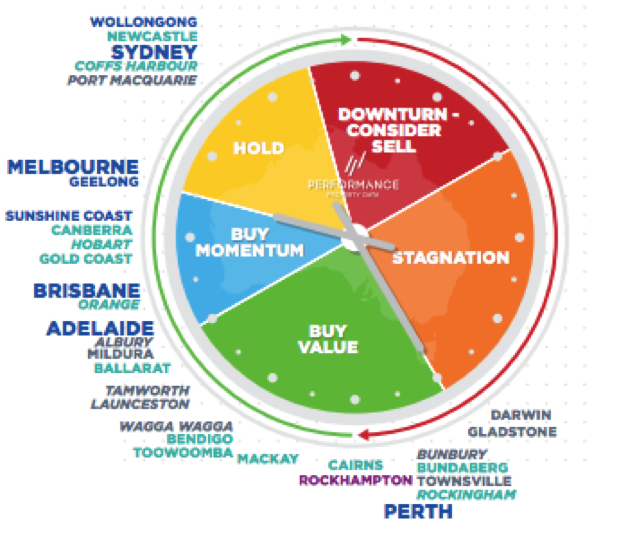

Research informs us that the property markets in most Australian capital centers are cyclical. They experience, on average, 5-10 years of growth followed by 3-7 years of negative growth (retraction). This is easily depicted on the “property clock” below. Money can still be made at any time in the cycle, however for best results you ideally buy between 6 and 9 o’clock, and do all your developing and selling up to 12 o’clock (peak of market) so the market is doing some heavy lifting for you. This is called compounding your value add with capital growth.

Figure 2 – Example of a Property clock (October 2019) Courtesy of PPA.

Leverage of other people’s money and debt.

Secondly, you have to learn how to make your money do as little work as possible – use borrowed money to do the hard work. You need to learn how to make your money work “smart” not hard. For example; it is possible to contribute less than 100% of the development costs from your own equity source as cash.

A percentage of costs (acquisition, subdivision and construction costs) can be funded with either OPM (others people money) and/or loan facilities, from a variety of different lending institutions. The art of leverage is your ability to minimise your own equity input and finance some, most, or all of the development with debt and other peoples money.

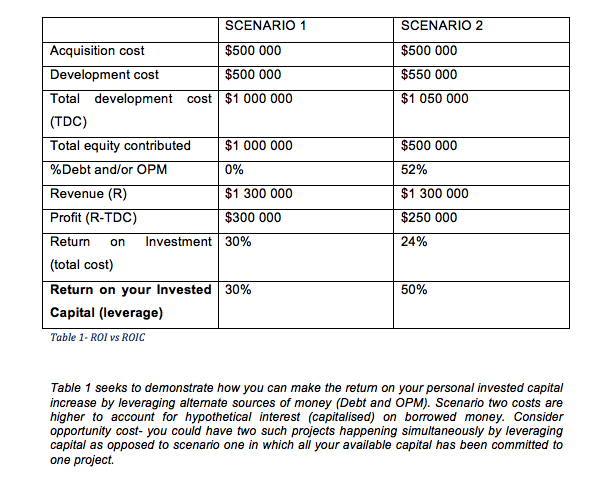

Leverage is the ability to maintain a reasonable return for yourself, given the risk exposure you have committed, whilst simultaneously minimising the amount of money (equity) you invest personally. This is done by giving other equity and debt participants risk consideration (a return) for investing their capital in the project. The return on every dollar you put in can actually increase significantly if you get the balance right, and provides the opportunity to possibly invest other money elsewhere (e.g. another project).

There is no reason you (and probably good reason) should not to put all your eggs in one basket. So if you can, have your money working for you in a few different places and investments. An example is provided below to illustrate:

Combining value adding strategies.

How do property developers make money? They understand and combine value adding strategies on property development projects.

The fastest model for financial gain in property is investing in short term property development model, with the objective to sell end products in a short period of time. It is advantageous if capital growth is working hand in hand with the development strategy, as discussed in the timing section of this article (so you are able to compound returns by developing in a rising market).

Property development and subdivision, particularly small lot infill developments, can also affect returns independently of capital growth in a flat or slowly growing property market, provided value is added to development sites that delivers product to an active market segment that can afford it (there is always demand for something!). Property development certainly has a higher risk profile than passive investing and holding. However, the rewards can be much higher if successful.

To develop successfully in the infill space, it’s important to employ a combination of strategies to add value to property in the near term.

For small lot infill developments, the typical time period for these projects is 6-18 months. Value-added property can then be sold for a profit, or borrowed against to repeat the process. Or a combination of the two. Initially however, for most developers property development will be a repeat business model with profits crystallised through sales transactions of all end products. This is different to buy and hold (capital growth and rental yield models).

Property development can combine the following strategies for near term value adding:

- Subdivision – Property Subdivision can be used as a stand alone development strategy. Or used together with one or both of the other value add strategies. Building and renovating focuses on the construction and refurbishment of houses. Subdivision is the complimentary land development component and is the process of subdividing larger blocks of land into smaller ones, getting titles, and then selling or building on them. It is important to note that you can subdivide and build concurrently or staged (one after the other), and the subdivision process is administratively separate to building approvals.

- Renovation – The low risk crowd favourite, renovation is the second value adding strategy you can use. This is where you renovate or refurbish an existing dwelling that you are keeping on a development site, typically in a retain and build or retain and subdivide scenario. “Renovate and subdivide” is a popular strategy combination for many novice and experienced developers alike, offering the ability effect a project turnaround in under a year with modest returns. Provided the renovations are kept mostly cosmetic, the need for planning approvals can be avoided too, and a strict budget can be adhered to without the need to engage a builder. Staging can also be effected (renovate, subdivide, then build) to leverage against progressive equity uplifts in property value and extract maximum returns.

- Building – The number three value adding strategy in property development is construction of dwellings. This strategy entails the design and construction of new housing products on the development site, either next to or on top of one another (e.g. single and grouped housing vs. apartments, depending on the zoning allowances). For any site, you can construct a choice or even combination of single, grouped, multiple or special purpose dwellings. It all depends on the market demand, the planning regulations for the area, and your budget. Profit driven research into these considerations will drive the best design solution for the site.

Combining at least two of these strategies is typically the best way to make the most money out of property development. Research and due diligence on a site is how we determine which of the three in combination is most suitable and profitable.

We hope this article has been helpful, teaching you a bit about ‘how do property developers make money’. Although, it just scratches the surface on what you need to know about strategy, leverage and finance, timing and staging a development. To learn more and remove the uncertainty, you need to spend some time on education.

Our most successful clients started their property development journeys through our education services. With guidance from the professional FLYNN subdivision experts team. many of the are now successful developers in their own right doing some good projects.

To learn everything you need to know about strategy, leverage and timing in more detail, there are comprehensive chapters and online modules on these topics in our 225 page Infill Property Developer Guide-book and correlating Online Course.